Regional Property Market Update Summer 2022: Scotland

Posted on: Wednesday, June 8, 2022

Mixed Messages

The housing market remains busy. Compared to the last ‘normal’ market of 2019, buyer enquiries are up 31% and mortgage approvals and sales are up by 12% and 11% respectively. However, there are half as many properties available to buy and stock levels are down 55% (Rightmove, HMRC, Bank of England). The prolonged mismatch between demand and supply continues to support prices. On average, properties are selling subject to contract in just 31 days, the quickest time ever recorded. With competition for properties remaining high, Rightmove report that asking prices have hit their fourth consecutive record high in as many months.

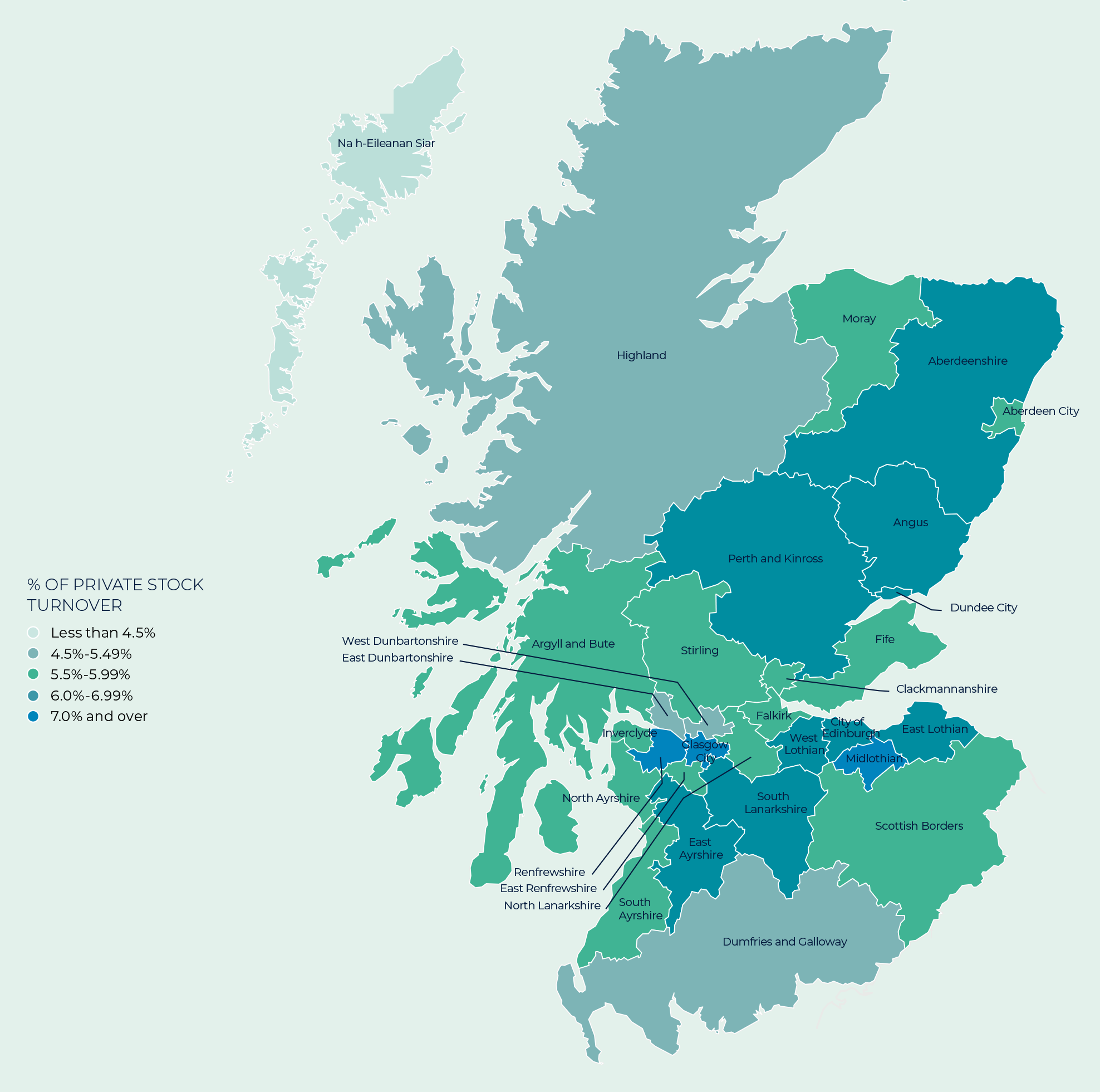

Over 433,000 homes in the UK changed hands in the first four months of 2022, making this the third busiest start to a year since 2007. Last year was an exceptional year due to Covid-19 and 2016 saw a surge prior to the introduction of the 3% additional homes surcharge. Except for last year, April 2022 has been the busiest since 2007 (Dataloft, HMRC). Scotland has seen the highest rate of property turnover of any region in the UK over the past year. Midlothian, the City of Glasgow and Renfrewshire are currently the most active housing markets in the region.

A perfect storm

Economic headwinds are gaining momentum. Expectations of global and UK economic growth have been pared back, while consumer confidence has plummeted to its lowest level since records began in 1974. Optimism is weaker than during the global financial crisis, Brexit or Covid-19 (GfK). The Covid recovery, war in Ukraine and rising energy and food prices, alongside a strong labour market and low unemployment, have created a perfect storm. Inflation is pushing a 40-year high. Thanks to fixed-rate mortgages, many households are cushioned from the impact of the latest base rate rise, but day-to-day budgets are increasingly feeling the squeeze.

Double-digit property price growth remains evident in many localities in Scotland, although annual price growth has moderated slightly compared to a year ago (ONS, UK HPI). Across Scotland there is less than two months of available stock left to sell, down by almost half on the historical norm.

Slow gear change

For many, the question is when, not if, the property market will start to moderate. However, any gear change is liable to be slow and steady, and not an emergency brake as was the case in the global financial crisis of 2008. Forecasters still anticipate positive price growth over the course of the year. Market fundamentals remain strong. A strong desire to move remains in the minds of many and there is a shortage of properties, compounded by data indicating that new home completions remain below pre-Covid levels and short of the government’s 300,000 homes target.

Contact us

As property prices and demand continue to rise, sell your property with experts in the property industry this spring. Contact your local Guild Member today.

Recent News

Autumn 2024 UK Property Market Report: Growing market momentum

Read More

Regional Property Market Update Autumn 2024: London

Read More

Regional Property Market Update Autumn 2024: Thames Valley, Berkshire, Oxfordshire, Buckinghamshire

Read More